Uranium Price Reporting

There is no formal exchange for uranium as there is for other commodities such as gold or oil.

Uranium price indicators are developed by a small number of private business organizations,

like UxC, LLC (UxC), that independently monitor uranium market activities,

including offers, bids, and transactions.

Such price indicators are owned by and proprietary to the business that has developed them.

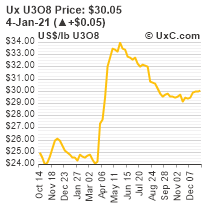

The Ux U3O8 Price® indicator is one of only two weekly uranium price

indicators that are accepted by the uranium industry, as witnessed by their inclusion in most

“market price” sales contracts, that is, sales contracts with pricing provisions that call for the future uranium delivery price

to be equal to the market price at or around the time of delivery.

A list of frequently asked questions (FAQ) about uranium price reporting was provided in the cover story of the October 21, 2019 issue of the Ux Weekly.

The Ux U3O8 Price® indicator is the longest-running weekly

uranium price series, dating back two decades. In addition to being used by the industry in sales contracts,

Ux price indicators have been referenced by the U.S. Government in the determination of price-tied quotas

and for determination of prices in the highly enriched uranium (HEU) deal between the U.S. and

Russian Governments. Ux price indicators are also referenced in The Wall Street Journal and other major

media publications when they discuss uranium price developments.

The Ux U3O8 Price is used as the settlement price for the

CME/COMEX UxC Uranium U3O8 Futures Contract (UX).

UxC employs a team of experts that collectively have over one hundred years of uranium

market and industry experience to assess price-related data and analyze developments that affect the uranium market.

It is important to note that, at all times, UxC remains an independent and unbiased entity in the

acquisition, analysis, development, and reporting of uranium pricing data.

Compliance with this policy has gained the long-term trust of the industry that

UxC’s price indicators are accurate and reflect true competitive market conditions.

Daily Uranium Spot Price

In September 2021, UxC introduced its daily determination and publication of the Ux U3O8 Price.

With a continued increase in market activity and frequency of transactions, UxC expanded its

data collection to allow for the shift from weekly publication of the Ux U3O8 Price to a daily

publication (excluding weekends and certain U.S. holidays).

All daily Ux prices are part of UxC's services to subscribers

and only available to paid subscribers of the Ux Weekly.

Additional details of this transition to daily reporting was provided in the cover story of the September 27, 2021 issue of the Ux Weekly.

Additional details of this transition to daily reporting was provided in the cover story of the September 27, 2021 issue of the Ux Weekly.

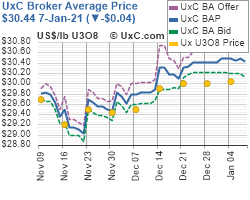

From September 2009 through September 2021, UxC published its daily UxC Broker Average Price (BAP) as

part of it services to subscribers.

Additional details of this price launch was provided in the cover story of the September 7, 2009 issue of the Ux Weekly.

Ux Price Indicator Definition

The Ux U3O8 Price® indicator is based on the most

competitive offer of which UxC is aware, taking into consideration information on

bid and transaction prices as well as the timing of bids, offers, and transactions (with a cut-off time of 2:30pm Eastern Time).

It is thus not necessarily based on completed transactions (although

a transaction embodies an offer and its acceptance). The “spot” market in uranium has traditionally

involved contracts calling for delivery as far out as 12 months, although currently most deliveries

take place in the forward one to three month (prompt) period.

Additional information on our price definitions can be found on our price page.

In its Ux Weekly® publication,

UxC goes into considerable detail about market developments,

including recent and pending transactions, outstanding requests for supply, and the changing

terms and conditions that characterize the market. UxC not only covers the spot uranium market,

but also the market for long-term contracts, as well as the spot and term markets for conversion

and enrichment. Important insights can be gained by examining the trends in different markets,

as well as the changing contracting and procurement policies of the industry. Thus, it is

important to know more than just a single price to understand what’s happening in the

uranium market, as well as other nuclear fuel markets.

Notice

The Ux U3O8 Price® and other Ux Price indicators

are developed by UxC, LLC (UxC) and are proprietary and exclusive intellectual property of UxC.

These price indicators are provided to UxC’s customers through the

Ux Weekly® publication and are made available on UxC’s public

website solely at UxC’s discretion.

They may not be reproduced or otherwise used without UxC’s express permission.

UxC®, Ux Weekly®, Ux U3O8 Price®, UxC BAP®,

U-PRICE®, and SWU-PRICE®, are registered trademarks of UxC, LLC.